Reality bites. So does the reality of artificial intelligence (AI). And, it seems to have bitten off 30% of the workforce at VerSe Innovation. The layoffs have not been to cut costs, but to shift the pivot from grey cells to black boxes.

As AI sweeps through the media and content landscape, there’s a visible rush among players to adapt to the evolving reality. The latest round of job cuts at VerSe in May this year was an impact of this rapid transformation.

For the parent of DailyHunt, bringing AI into its core was a desperate bid to monetise the venture, bring more advertisers, and mobilise its short video platform Josh.

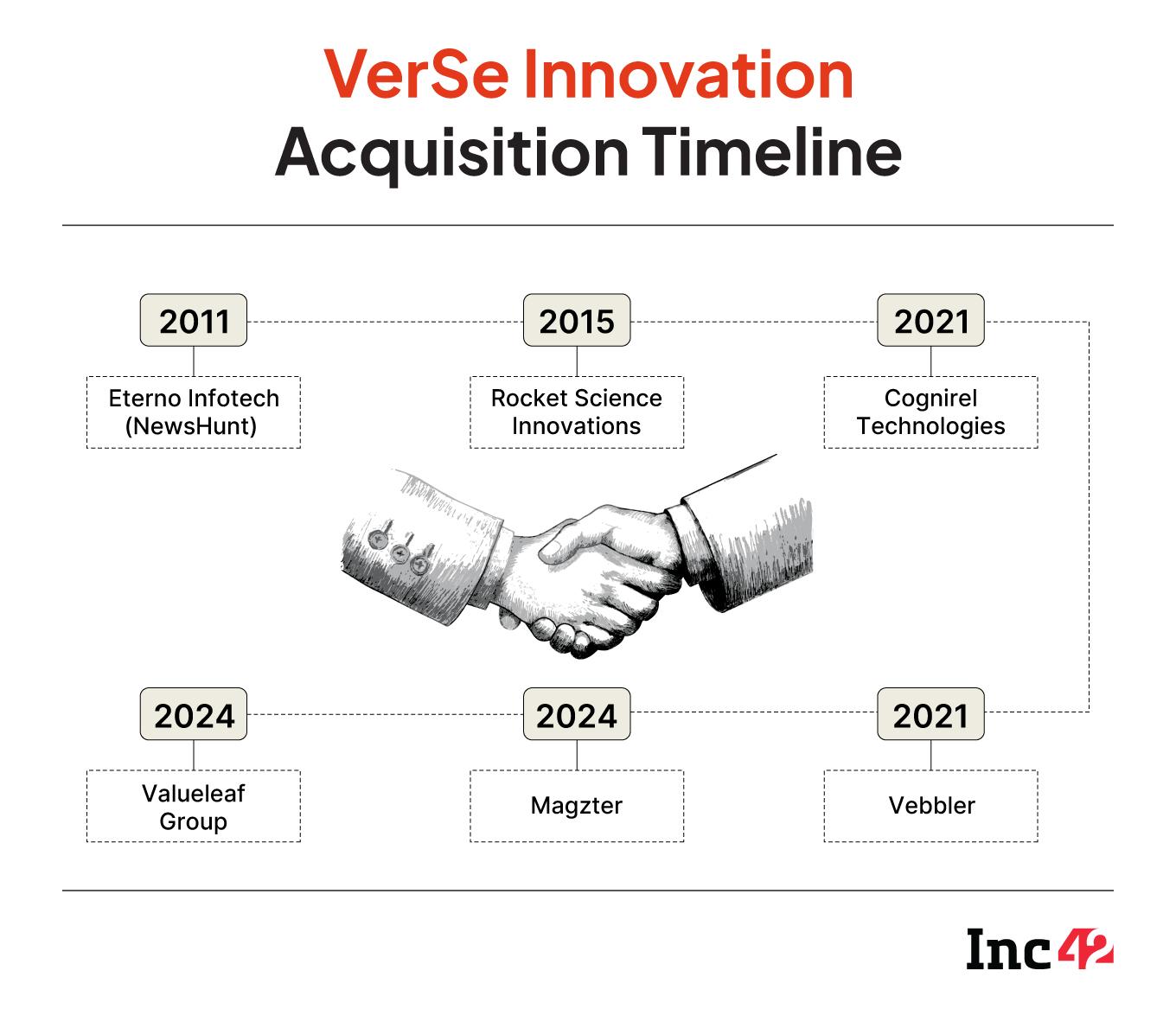

A series of acquisitions made over the last few years weighed on the coffers of VerSe, which served telecom companies by sending out SMS alerts on jobs, property, matrimony, news and education to subscribers across India, Bangladesh and Africa, when Virendra Gupta rolled it out in 2007.

The company went on a buying spree when it entered the B2C game in 2011 with the acquisition of Eterno Infotech. All the six acquisitions made so far worked great until the GenAI wave disrupted the industry.

Once valued at $5 Bn, with backing from global marques like Google, Matrix Partners, and Sofina Ventures, VerSe last raised a venture debt of INR 50 Cr ($6.25 Mn) from Alteria Capital in February 2024.

Once valued at $5 Bn, with backing from global marques like Google, Matrix Partners, and Sofina Ventures, VerSe last raised a venture debt of INR 50 Cr ($6.25 Mn) from Alteria Capital in February 2024.

Most of its over INR 14,195 Cr ($1.7 Bn) funding raised so far came during 2020 to 2022, when digital platforms were coming up as the next big thing for content and short-form videos, and a $176 Mn AI-led media market in India began expanding at a lightning speed to reach $3 Bn by 2032. The entire media and entertainment sector saw AI redefining content creation, distribution and monetisation that made it an INR 268,000 Cr (around $31.6 billion) industry in 2025.

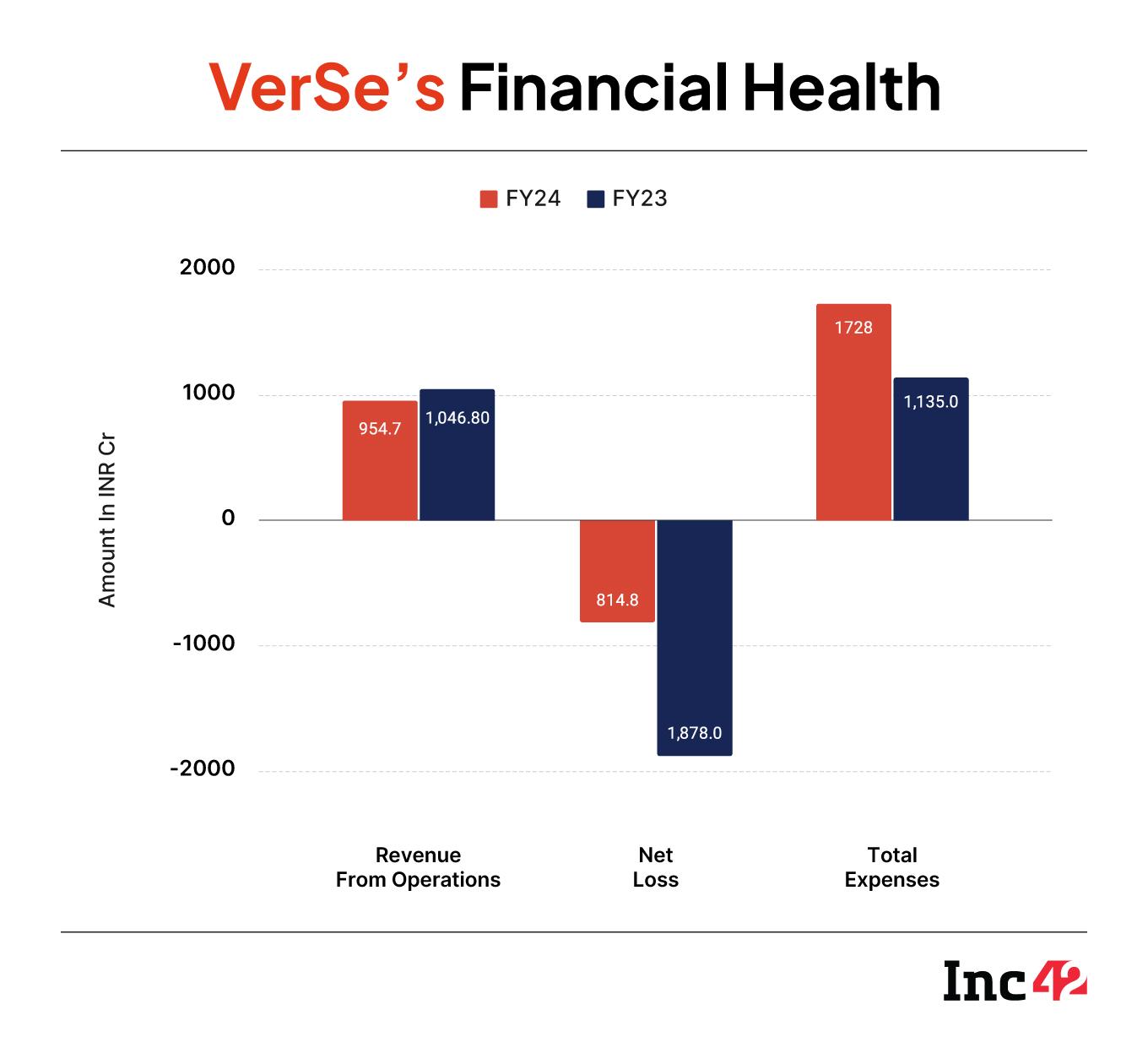

With the AI disruption unfolding in full swing, content creation companies began looking at how it could improve their productivity and efficiency. VerSe focussed on automating several manual processes to enhance operational efficiency. It also reduced its EBITDA burn and shrank its losses by 51% to INR 710 Cr in FY24 by cutting down expenses.

The company has not yet shared the revenue breakdown of various verticals along with financials for FY25, but the management has stepped on the gas to raise funds for its subsidiaries, insiders told Inc42.

But how did VerSe fail to rhyme?

Josh Loses The Jazz: Revenue-Grosser Or Cash-Guzzler?Josh was one of the biggest investment drivers for VerSe from 2020 to 2022, when India slapped the ban on TikTok, and claimed to have 350 Mn monthly active users (MAUs).

The excitement, however, fizzled out by 2024. It suffered a staggering downfall in MAUs and downloads following an exodus of influencers from the platform because of poor content moderation and overall decline in the user experience. Simmering competition from Instagram Reels and YouTube Shorts too pushed Josh and its homegrown peers to the edge.

“Josh saw growth during elections when political parties would carry out campaigns because of its sizable Hindi-speaking users. There were also regional advertisement-linked revenues when brands would tie up with local influencers on this platform to reach the masses,” a former senior executive at Josh’s user engagement team said.

As the userbase shrank, brands began shying away from Josh. And, Josh quietly pivoted to adult content videos to stop the churn in its userbase, VerSe insiders shared. The shift to adult content was a desperate bid as the platform struggled with the revenue tap running dry. Short video apps like Chingari, according to industry sources, too have pivoted to adult content.

Given stringent regulatory scrutiny and strict content moderation rules in place, it is unlikely to be easy for these apps to make money, while they may also face erosion in influencers and users.

Josh, however, denied such a move. “It is a 100% brand-safe platform, with no live video or tipping features, and we take brand and content integrity extremely seriously,” it said in a statement. “The content on Josh is consistently moderated and benchmarked to ensure it stays well within the boundaries of acceptable, mainstream content.”

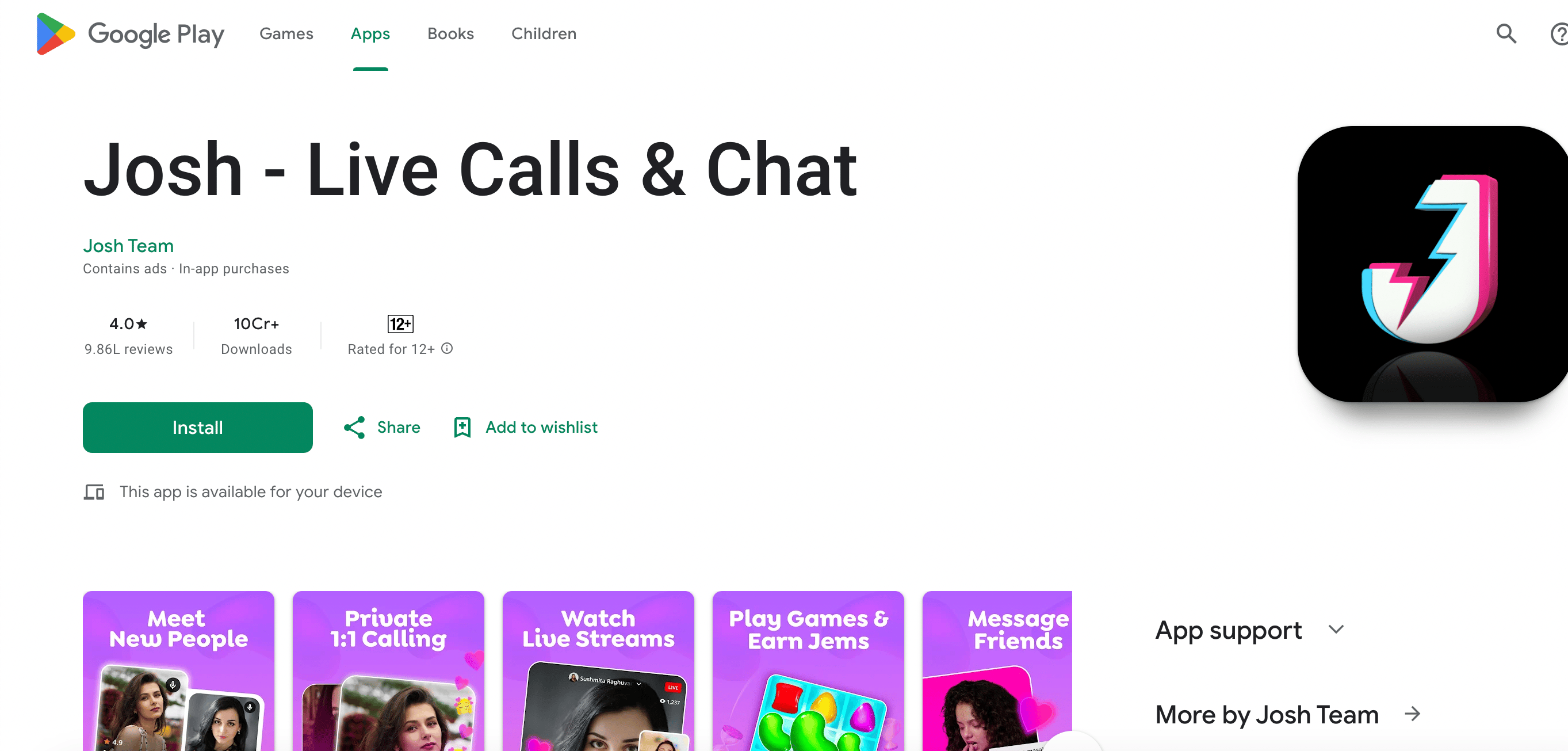

In a bid to jack up the revenue, Josh also introduced the 1:1 call feature and made it a subscription model with prices starting at INR 14 per minute on the call and above. “We strongly encourage you to explore the app firsthand – you’ll see that Josh is entirely safe, with zero adult content and a clear commitment to being a responsible, trusted platform,” the statement urged.

Journalists at Inc42 used the paid audio call feature on Josh, listed as suitable for 12+ age groups on Playstore, and found mostly women responders, talking in a flirtatious manner and asking for sensitive information.

Although its FY24 revenue breakdown is also not available, Inc42 had reported that the short video app contributed only INR 300 Cr to its FY23 topline of INR 1,456 Cr.

VerSe had earlier said that it was looking at brand partnerships and sponsored content as a key revenue stream. In a cash-strapped short-video industry, the growth has been stunted due to higher customer acquisition costs, increasing influencer payouts, and over-dependence on advertisement for revenue.

Josh has been struggling with the same set of issues, despite being one of the most well-funded short-video apps. Nearly 70% of the funding raised by VerSe was spent on Josh to capture the market vacated by TikTok, according to Inc42’s rough estimates.

VerSe, however, argues that Josh draws its revenues from multiple streams, including Josh Influencer Marketplace (which connects brands with creators), advertising, branded content partnerships, and Dream Call.

DailyHunt In AI Days: Local Content To Ride Global TrendDailyHunt was a leading news aggregator platform along with Inshorts with contractual agreements with publications and agencies for putting up their news articles on its app against payments. Sometimes, young publishers and agencies would pay the aggregators to use their digital reach.

The platform came under pressure from publishers when it ran into a funds crunch and delayed payments. Many publications deserted the platform, leading to a loss in its userbase, a former VerSe executive told Inc42.

VerSe, however, claimed to have squared all dues on time in accordance with the contracts.

While DailyHunt grappled with a churn in users, even the most bustling newsrooms rushed to restructure their content strategies as GenAI had stormed into daily reading and information gathering habits, disrupting news aggregation and curation.

As GenAI and Google Analytics make their way into the newsrooms in a big way, India leads the world when it comes to comfort with AI-generated news, found the Reuters Digital News Report 2025, which said 44% of Indians are happy with AI delivering the headlines, far surpassing markets such as the UK where only 11% echoed the view.

VerSe too went on to implement AI in news curation and aggregation in 2024 that eventually led to the firing of nearly 500 employees. There was also a churn at Josh across senior-level positions. “There are cases where ML and data analytics are being used to generate personalised content recommendations and automatised summaries of articles which reduce dependence on human-centric roles and give better outcomes,” the VerSe executive who was responsible for content curation told us.

While the AI-first approach has made the company leaner and enhanced its productivity tools, the question of monetisation still gropes for an answer.

On A Rough Patch: Blazed Ads, Steeper Race, Bloated BooksDigital media advertising grew 14% to INR 45,292 Cr in 2024 with videos making up 27% of the pie, said the Pitch Madison Advertising Report 2025. Digital news monetisation is, however, likely to see a muted growth of 5-7%, said the Digital News Publishing Interactive.

While advertising continues to pave a major part of the monetisation avenues for digital news publishers, subscription news has begun gaining momentum.

In this backdrop, DailyHunt is facing a fresh battlefront with the competition widening from rival aggregators to AI-led tools of major search engines, backed by vast data and computational resources.

The VerSe management stressed that DailyHunt was India’s topmost local language content platform offering more than 1 Mn articles every day in 15 languages. “The content on DailyHunt is licensed and sourced from a creator ecosystem of over 50,000 partners and a deep pool of over 50,000 creators,” it told Inc42.

The aggregator has also expanded beyond news, offering astrology, entertainment and motivational content to attract users.

VerSe managed to reduce its cash burn by 56% to INR 814 Cr with a steep cut in customer acquisition costs, server costs, and employee expenses. It now expects over 75% surge in revenue in FY25, outpacing an anticipated 10-15% growth in digital advertising.

Even before VerSe could regain from a decline in FY24 revenue, its auditor Deloitte flagged weaknesses in internal control. It said that VerSe’s revenue recognition practices across its digital ads, news aggregation and publishing platforms were not at par with the Indian Accounting Standards. From not correctly recognising Josh as a virtual asset to misstating purchase orders from vendors and recognising marketing revenues – the auditor raised several points.

“The financials are true and fair with a clean report. The controls within the company were identified as weak by Deloitte, however, it is confirmed that these have no impact on the company’s consolidated financial statements,” cofounder Umang Bedi told Inc42 earlier.

Bedi also said that the company will adopt a revenue recognition practice in FY25 and achieve breakeven in the second half of next fiscal. “We have initiated a comprehensive remediation programme, supported by a dedicated internal task force and leading external consultants, to resolve the Internal Financial Control (IFC) deficiencies.”

A Bloomberg report, meanwhile, alleged that VerSe was involved in round-tipping of revenues with London-based bankrupt AI startup Builder.ai to falsely inflate each other’s revenues to the tune of $60 Mn between 2021 and 2024. While VerSe superficially faked marketing revenues from Builder.ai, the British startup showed revenues from the Indian company with respect to app development, cloud service usage and allied services, it charged.

VerSe, however, denied the allegations and reportedly claimed to have availed $80 Mn of services from the AI firm and in turn received $53 Mn for marketing services. The company said these transactions went through strict scrutiny in its FY24 statutory audits.

While VerSe investor 360 One slashed the company’s valuationby as much as 41% last year to $2.9 Bn, some key exits from the finance team, including that of group CFO Sandip Basu’s, just before filing the FY24 financials also created some difficulties.

Revival Route: Can AI-Focus, New Features Fend It Off?Amid sustained headwinds and a general slowdown in digital news media, VerSe is focussed on its next suite of products and services like NexVerse.ai, an AI-powered programmatic AdTech engine, Dailyhunt Premium, One India, and Josh Audio Stories.

While its flagship businesses went under stress, VerSe is betting big on its AI-driven approach and some of the acquisitions to turn around. The company was also weighing an IPO until it hit the rough patch.

Let’s take a look at the revival route the content company has mapped.

OneIndia: The company hopes its original content and a strong user base in local language markets will drive ad revenues along with subscription-based vernacular content.

Magzter / Dailyhunt Premium: VerSe is providing bundled e-subscriptions with a sticky userbase through Magzter, which was rechristened Dailyhunt Premium after acquisition. This reduces the dependency on advertisers beyond rural and tier II markets and concentrates more on urban centres.

NexVerse.ai: The product combines ValueLeaf’s proprietary data and performance marketing tools to help brands deliver returns and target the correct set of audiences through digital advertising. VerSe expects ValueLeaf’s acquisition will increase its revenue by charging a premium from advertisers and grow the average revenue per user. In a statement, the company said that the acquisition would add $100 Mn to its topline in FY25.

Josh Audio Stories: Josh has begun experimenting with audio features at a time when the likes of Kuku FM, Pocket FM, countless audiostreaming platforms and podcasts are rapidly gaining popularity. Josh is betting on its regional language audio features. There are also audio call features within the app which require users to pay to talk to the creators. The in-app purchase revenue is shared with the creators.

VerSe Innovation has been shedding old layers of non-functioning businesses and corporate jobs for an AI makeover – somewhat like Microsoft and Amazon. But, unlike the deep-pocket tech giants with their huge user base and native AI tools, players like VerSe have a lot at stake.

Bedi and his team have surely made bold moves over the last one year, understanding the changing paradigm in the content creation ecosystem, but aligning its business goals with the investor interests will be the key.

[ Edited By Kumar Chatterjee]

The post Josh In Jeopardy, Funds Run Dry For DailyHunt: Can AI Get VerSe Back In Rhymes? appeared first on Inc42 Media.

You may also like

Sarkari Naukri: Job opportunity in NIT, salary more than 2 lakhs, age limit 56 years..

Tamil Nadu: Train hits school bus in Cuddalore; several children feared dead

Trump puts 25 per cent tariffs on Japan, South Korea; new import taxes on 12 other nations

XAT 2026: XAT 2026 exam on January 4, application will start soon, 250 MBA colleges accept scores..

Rajasthan PSC Releases Admit Cards for Research Assistant Exam 2024