From establishing itself as the leader in India’s online beauty and personal care (BPC) space to making a successful public market debut, the last decade has been nothing if not eventful for Nykaa.

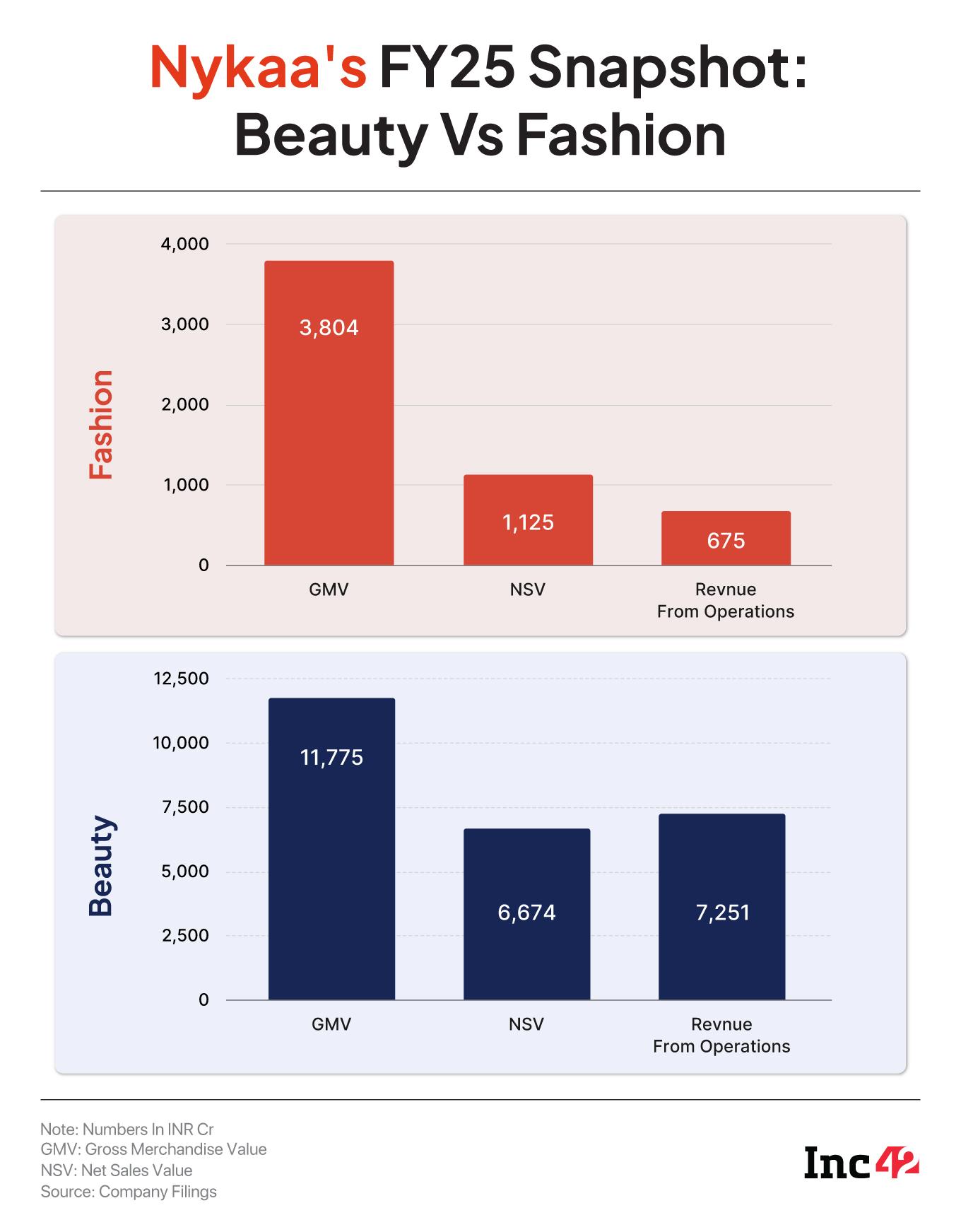

However, behind this action-packed streak of 10 years has been the ecommerce major’s beauty and personal care (BPC) vertical, which has shown consistent growth and profitability. For context, Nykaa’s BPC revenues rose 25% year-on-year (YoY) to INR 7,251 Cr in FY25, and its gross merchandise value (GMV) grew 30% to INR 11,775 Cr.

On the other hand, Nykaa’s fashion segment has struggled to shine and shimmer.

Since its launch in 2018, the company has experimented with multiple makeovers, from a strong private label push to premium positioning, as well as a focus on external brands, including both international and Indian D2C labels, but the impact has only been skin-deep.

Compared to the rapid growth of its beauty vertical, Nykaa’s fashion segment closed the fiscal year (FY25) with a GMV of INR 3,800 Cr, up a mere 12% YoY, and revenues of INR 675 Cr, up 19%.

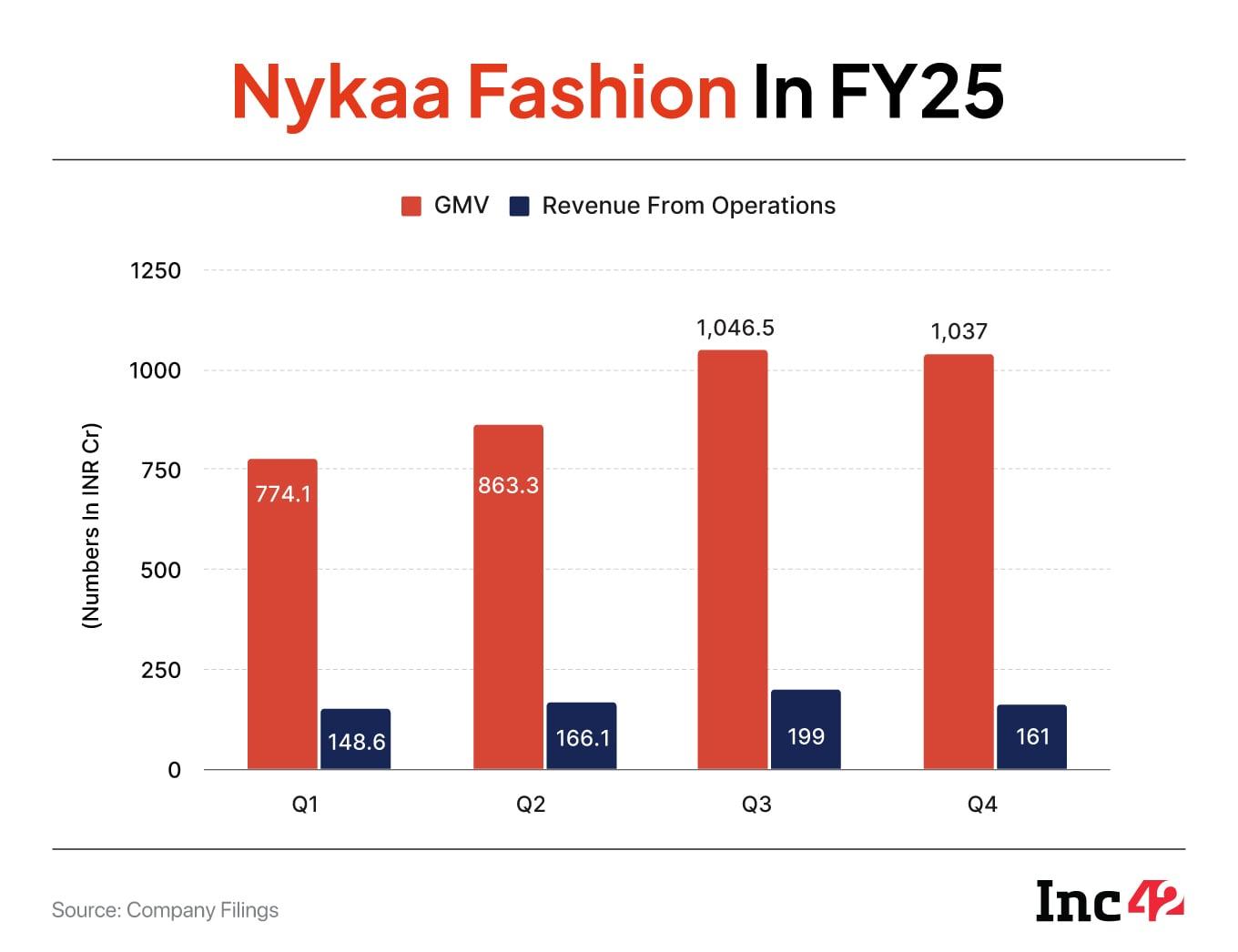

Even as the beauty and fashion ecommerce giant claims that its fashion platform saw a recovery in growth during Q4, the company acknowledges that the overall growth of the vertical was impacted by the muted performance of its owned brands, among other things.

Abhijeet Dabas, business head of Nykaa Fashion, believes, and as he highlighted in the company’s Q4 earnings call, that the segment is headed in the right direction. “As we are playing to our strengths, numbers will continue to look up.”

However, analysts see that Nykaa Fashion’s road is fraught with cracks, which no amount of makeup can hide, at least for now.

To begin with, the overall fashion market in India is witnessing muted growth, with the sub-INR 1,000 category growing more than the premium segment. This unprecedented growth has pushed bigger players into a tight corner, and Nykaa is no exception.

A key casualty of this trend is Shoppers Stop, which recorded a 91.4% decline in its consolidated profit in the fourth quarter of the financial year 2025. The company’s net profit crashed to INR 1.99 Cr in Q4 FY25 from INR 23.18 Cr in the year-ago quarter.

Similarly, lifestyle and fashion retailer Trent, which runs Westside and Zudio, reported a 55% YoY decline in its consolidated net profit for the March quarter at INR 318 Cr, compared to INR 704 Cr in the same period last year.

Nykaa Fashion’s Faux PasOne of the fundamental challenges with Nykaa’s fashion business is that it hasn’t been able to replicate the discovery-driven behaviour it enjoys in beauty.

Nykaa is often the first point of search and discovery for consumers, whether they’re looking for a new skincare brand, the latest makeup launch or product authenticity. However, that consumer habit simply doesn’t mirror in the fashion segment.

“When it comes to fashion, primary discovery still happens on Myntra for most online shoppers,” Satish Meena, founder of Datum Intelligence, said. “Nykaa isn’t the top-of-mind destination when someone is thinking of buying clothes or shoes.”

Customers typically begin their fashion discovery on platforms like Myntra or Ajio, where the breadth of selection, aggressive pricing, and fast inventory churn dominate the consumer mindset.

Nykaa struggles to acquire fashion customers organically. In fact, as per market observers, the platform invests heavily in performance marketing to lure shoppers in. However, aggressive marketing alone is just like lipstick on a pig if the value proposition doesn’t click with customers’ aspirations.

Also, this often leads to higher customer acquisition costs that do not guarantee a strong repeat rate, according to Meena.

“Fashion discovery is visual, trend-led, and highly price-sensitive. Customers usually browse on platforms where they expect variety, fresh drops and steep discounts. Nykaa doesn’t own that space yet,” a marketing executive at a rival fashion startup said.

Operationally, fashion is also significantly harder to manage. Unlike beauty, where products are compact, standardised, and have negligible return rates, fashion is plagued with high returns.

“Return rates in fashion can easily cross 20-25%, depending on the category, which puts tremendous pressure on logistics and eats into margins,” Meena said.

According to a former Nykaa executive, the ecommerce giant’s one-size-fits-all strategy has been of little help.

What this essentially means is that the company attempted to scale its fashion business the same way as it did with the beauty segment.

According to experts, beauty is a ‘replenishment category’. Simply put: Customers come back every few months to repurchase skincare, haircare or makeup products, which helps companies create high repeat rates and lower customer acquisition costs over time.

Fashion doesn’t follow this pattern because, as an average consumer may shop for apparel or accessories a few times a year but rarely with the same brand.

“Nykaa’s core strength lies in habit-forming categories, but fashion is neither habit-forming nor frequency-driven the same way,” Meena said.

This is precisely what has made it difficult for Nykaa to build fashion into a sticky, profitable business, at least so far.

But, on the back of a sharp focus on brand onboarding, customer acquisition, and strengthening assortment, Nykaa Fashion’s GMV showed some signs of growth in Q4 FY25.

Nykaa Fashion’s Dabas acknowledged that while the core proposition hasn’t dramatically shifted, the company is investing heavily in making its portfolio more attractive.

During the earnings call, he pointed out that the company was looking to partner with aspirational labels like Victoria’s Secret, Rare Rabbit, and Hopscotch to attract shoppers and unlock more value from users. Nykaa is also doubling down on customer acquisition, anticipating future tailwinds.

On the operational front, Nykaa is focussed on a marketplace-led model where the inventory risk is limited to its private labels.

“The inventory-led business is mostly restricted to fashion own labels,” Falguni Nayar, founder and CEO of Nykaa, said, underlining the company’s strategy to mitigate losses and minimise return-related costs.

Hemmed In By HeavyweightsEven as Nykaa is trying to sustain the growth momentum it witnessed in the recently concluded quarter (Q4 FY25), it risks tripping on the ramp in its attempt to catwalk with the heavyweights.

According to an industry analyst, Nykaa Fashion holds a single-digit market share, while Myntra and Flipkart Fashion together command nearly 50% of the total ecommerce apparel sales.

Besides, Ajio and Tata Cliq have carved out their own spaces — Ajio through aggressive pricing and fast-fashion offerings, and Cliq with a sharp focus on premium and luxury segments.

Now, the market has become even more cut-throat with the re-entry of Shein, this time backed by Reliance.

What makes Shein’s comeback particularly disruptive is its supply chain innovation, which allows it to offer ultra-affordable products. Add Reliance’s massive physical footprint — via Ajio’s platform and over 19,000 stores across India — and the competitive bar rises even higher.

No. The company has come too far to retreat now.

Also, when you are a listed entity, category expansion is closely monitored by investors. “The better you are at being able to demonstrate diversified offerings, the higher the value you create in the mind of the investor,” an industry analyst noted.

But the trade-off is visible. Market analyst Kush Ghodasar said that Nykaa’s foray into fashion, particularly in the form of luxury white-labelling, is squeezing its margins.

Apparel is naturally a low-margin, high-return segment, and in his view, the fashion revenue currently is not adequately offsetting the dilution in profitability from Nykaa’s core BPC business.

“As an investor, I would prefer Nykaa to remain a cosmetics-led brand because the fashion category has much more competition from established players,” he added.

As of now, what is on the line here is investor confidence, which is directly tied to brand positioning and profitability. Over the years, Nykaa has built a moat through trust, curation, and an upscale beauty-buying experience.

Watering that down to pursue fashion scale in an over-competitive setting may confuse the core customer and destroy the premium perception Nykaa commands. Therefore, the next 2-3 years can be rough for the company, which may have to grapple with low margins in the realm of fashion.

This makes us wonder: Can Nykaa break fashion organically? Or will it have to make a strategic pivot, possibly through partnerships, acquisitions, or more vertical intensification?

[Edited by Shishir Parasher]

The post Is Nykaa Fashion Running Out Of Vogue? appeared first on Inc42 Media.

You may also like

'Can finally hug my wife, son...': What Mahmoud Khalil said after walking free from detention after 104 days; watch video

Operation Sindhu: India to evacuate Nepalese and Sri Lankan citizens from Iran; issues emergency lines

Indian stock market shrugs off midweek volatility, ends week on robust note

OpenAI co-founder and CEO Sam Altman thinks your child will never be smarter than Why is that a good thing?

World going through tensions, Yoga gives direction of peace: PM Modi