Days after Medikabazaar fired founder and ex-CEO Vivek Tiwari from its board for alleged financial irregularities, much has emerged from the closed closets of the B2B medical supply startup.

A petition filed by Tiwari before the Delhi High Court and the legitimacy of the board’s decisions. On the flip side, investors have trained guns on him for alleged financial irregularities. The court will hear the matter later this month.

What Has Tiwari Pleaded? In his petition, Tiwari has sought a stay on any alterations to the startup’s board structure or promoter rights until the end of the arbitration. He has questioned how CFO Raman Chawla was allowed to lead the internal investigation against him, even though the latter himself was named in a whistleblower complaint.

Board Paints A Different Picture: The board has accused Tiwari of financial mismanagement, governance failures, and fraudulent conduct. An investigation by Uniqus India, Alvarez & Marsal, and Rashmikant & Partners, too, found and overstating revenue by more than 60% in FY23, among other things.

Ex-CEO’s Allegations Run Amok: In his plea, the Medikabazaar founder has accused the company’s investors of orchestrating a plan to unlawfully strip him of his position and rights as a promoter.

Tiwari, who owned a 39.3% stake in Medikabazaar, alleged that the company’s board barred him from attending a last-minute meeting in August 2024, where the members allegedly passed a resolution to terminate him as the CEO.

Tracing The Dispute To Its Roots: In December 2023, a whistleblower, in a plaint, alleged that Tiwari, Chawla, and 15 others were involved in financial irregularities at the B2B startup.

With the ball now in Delhi HC’s court, here is our deep dive into the latest twist in Medikabazaar’s long tale of boardroom brawl over alleged misgovernance and financial irregularities.

From The Editor’s Desk: Jumbotail’s acquisition of Solv India has raised valuation and leadership concerns, with insiders questioning looming layoffs, and doubts over whether two loss-making B2B players can revive momentum in a tough market.

: The EV major has filed its RHP with SEBI and is set to become the first new-age tech company to list this year. Amid the ongoing volatility, it has cut its IPO size, which will now comprise a fresh issue of up to INR 2,626 Cr and an OFS of up to 1.1 Cr shares.

: The operator of QSR chains like KFC, Devyani, is set to acquire a controlling stake in cloud kitchen brand Biryani By Kilo. The startup, which runs 100 outlets across India, cut its net losses by 30% YoY to INR 70.81 Cr in FY24.

: Marking its first full year of profitability since its inception in 2018, the real money gaming platform reported a PAT of INR 146 Cr in FY24 versus a loss of INR 36 Cr a fiscal year ago. Its top line surged 36.5% to INR 1,123 Cr from INR 823 Cr in FY23.

: The law enforcement agency is preparing to question Gensol Engineering promoters Anmol and Puneet Singh Jaggi in connection with the Mahadev Book illegal betting app. It recently froze over 500,000 shares of Gensol Engineering.

The IPO-bound cloud kitchen startup has secured $25 Mn from Qatar Investment Authority. The funding is said to have been raised at a valuation of $1.4 Bn. Recently, Rebel Foods forayed into the 15-minute food delivery segment with ‘QuickiES’.

: The enterprise tech startup has raised $20 Mn in its Series C round led by existing investor Nexus Venture Partners. Founded in 2022, Uniqus offers consulting services for finance operations, governance, risk, ESG, and technology.

: Indian startup investors are groping in the dark to understand the impact of the US’ tariff decision on the country. Even though most VCs see India in a more advantageous position than China, Mexico, and Canada, they are cautious for now.

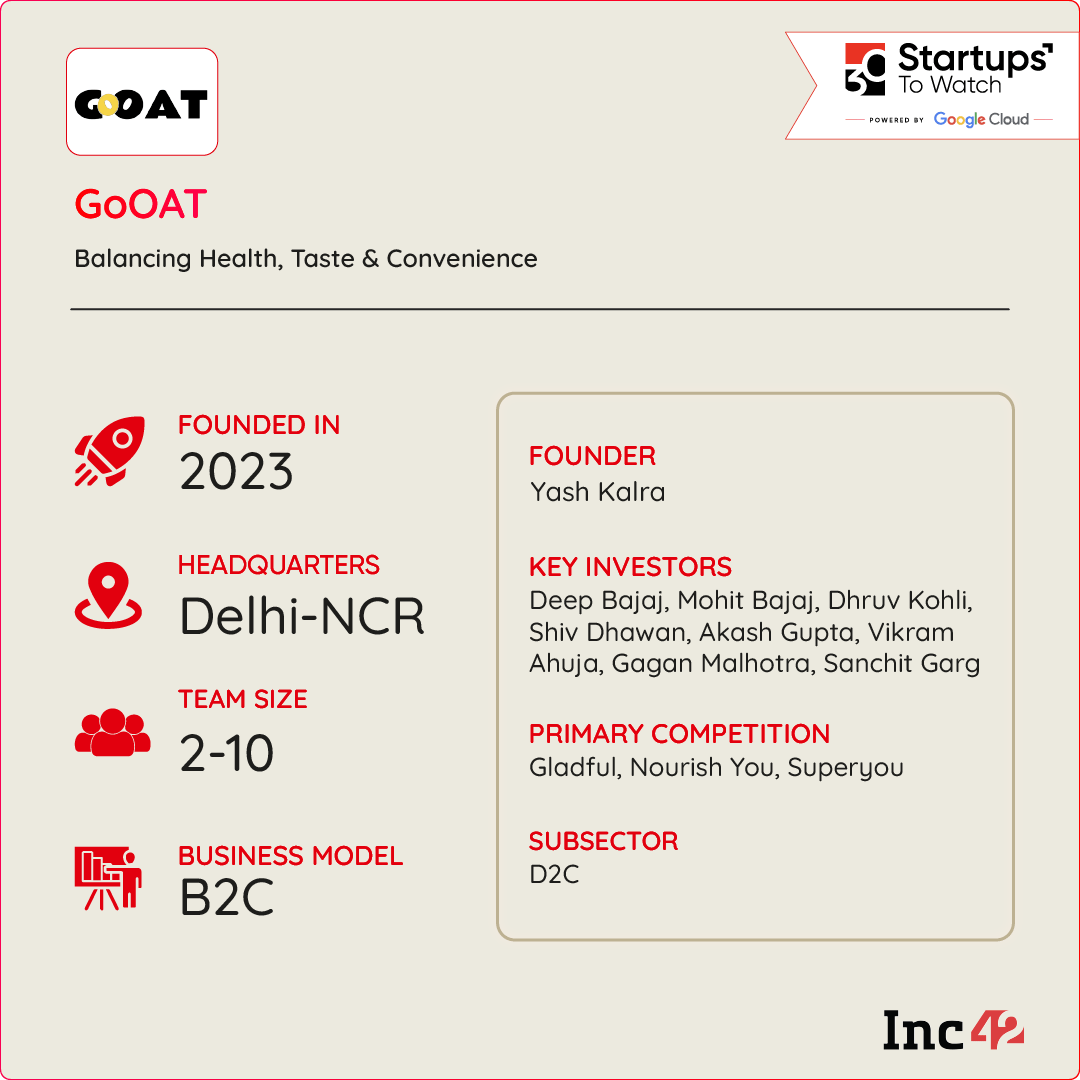

Inc42 Startup Spotlight Can GoOAT Disrupt The Breakfast Market For Busy Officegoers?Skipping breakfast to beat the morning rush has become a common theme for most officegoers. However, GoOAT is super-focussed on changing this. The startup is focussed on making breakfast effortless.

Solving The Nutrition Puzzle: Founded in 2023, GoOAT is a high-protein meal-focused D2C startup, which offers quick-to-prepare high-protein oatmeals. Its oatmeals are made with pure whey, chia seeds, flax seeds, and dried fruit powder, with multiple flavours and no preparation headache.

A Big Market To Conquer: As India’s F&B market races toward a $68 Bn mark by 2030, GoOAT locks horns with D2C brands like Wellbeing Nutrition, Pluck, and Plix, who are already in the ring.

But, in a market that is already dominated by legacy giants like Quaker, Saffola, and Kellogg’s, ?

The post appeared first on .

You may also like

Vile, senseless act: Global condemnation pours after Pahalgam terror attack (Ld)

'Donald Duck took my visa': Colombian president Gustavo Petro mocks Trump over travel ban

PM Modi didn't overfly Pak on return to Delhi

J&K terror attack: PIL in SC over safety, security of tourists in hilly and remote areas

"Intelligence failure": Asaduddin Owaisi asks govt to "fix accountability" for Pahalgam terror attack