If there is an outlier in the UPI ecosystem when it comes to commanding a top spot at an unusually fast speed, it is Flipkart’s super.money.

Since its launch last July, the fintech has overtaken players like CRED, Amazon Pay and WhatsApp Pay, helped by aggressive cashback campaigns. However, there is more than meets the eye here.

Let’s find out what…

At the time of its launch last year, many assumed that super.money would leverage its parent platform, Flipkart, to gain a firm ground in the country’s UPI market, otherwise dominated by a handful of players.

But to everyone’s surprise, super.money chose a different path and built an independent fintech app with an independent user acquisition model. It is targeting a specific set of young, credit-hungry, digitally savvy power users, who are more likely to adopt value-added financial products such as credit cards, savings instruments, and personal loans. This is what super.money’s product strategy is all about.

And, the growth has been exponential since.

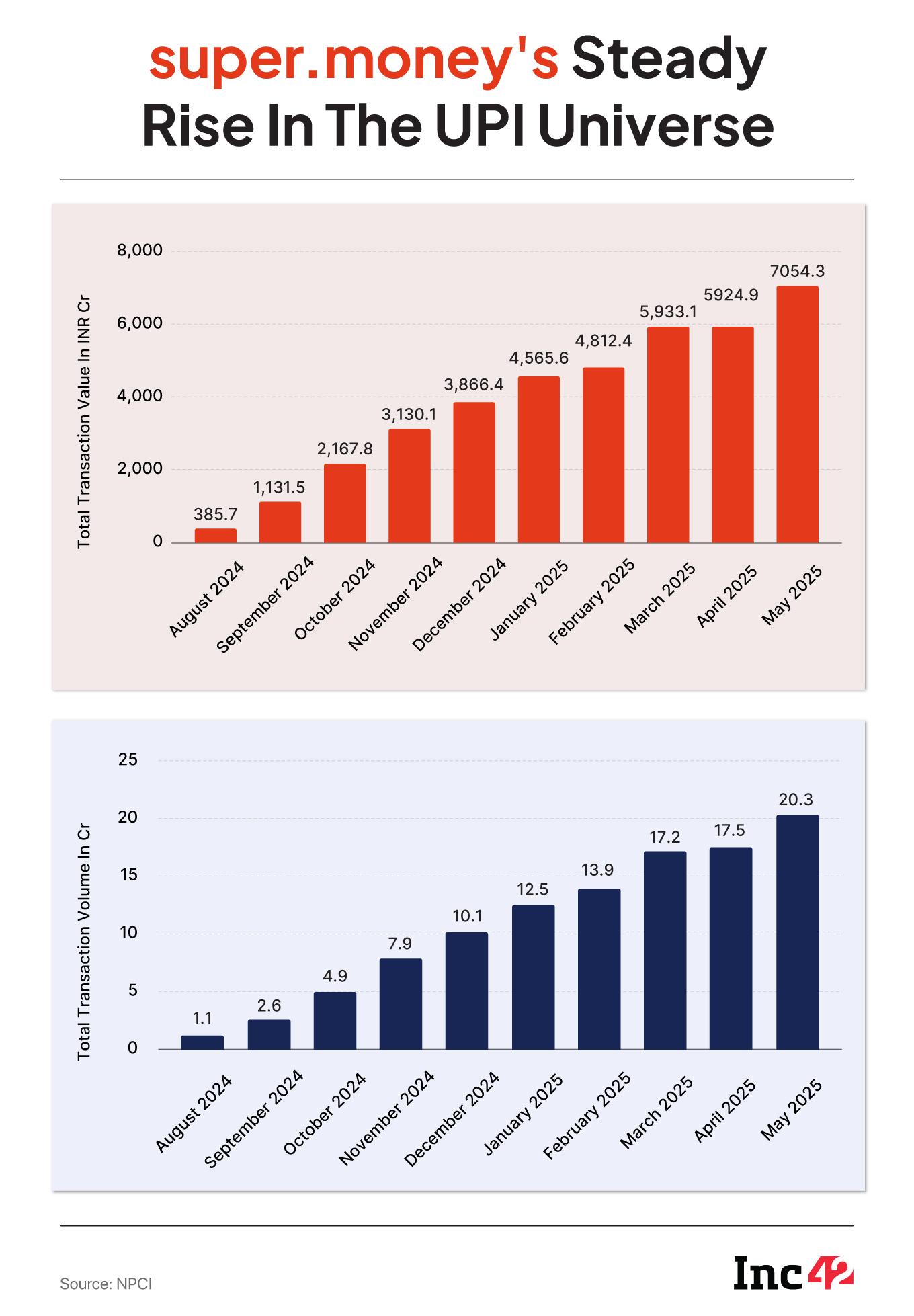

In May 2025 alone, super.money handled 20.3 Cr transactions worth INR 7,054.28 Cr, surpassing competitors Cred and Amazon Pay.

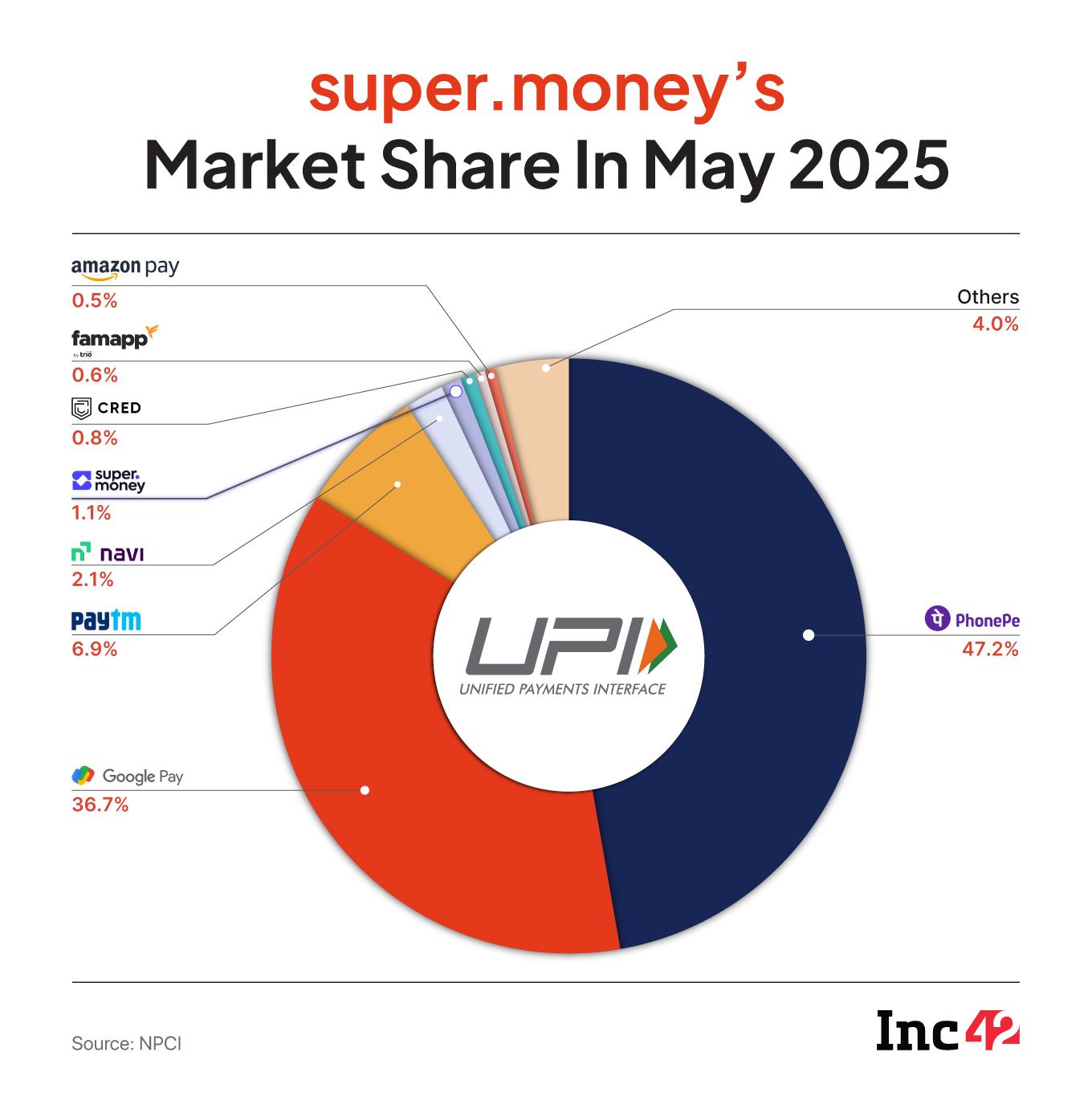

However, unlike Google Pay, Paytm and PhonePe, which dominate more than 90% of the UPI market, super.money isn’t competing purely on volume.

The growth, according to the super.money management, isn’t the result of chasing scale at all costs but about picking the right battles.

“We’ve always said that we want to be the preferred UPI app for 10 to 30 Mn users — people doing 30 to 40 transactions a month… We’re very happy being there. We’re not competing with PhonePe or Google Pay,” Prakash Sikaria, the founder and CEO of super.money, told Inc42.

Unlike its more generalist peers, super.money has carved out a niche as a scan-and-pay first UPI app, designed to emotionally connect with young, affluent users.

This sharply contrasts with Amazon Pay’s integration within its ecommerce platform or PhonePe and Google Pay’s broad, mass-market approach.

While the leading UPI apps largely focus on adding more users and driving scale to monetise via ads, coupons and brand partnerships, super.money is playing a different game.

“Our core proposition is built on rewards and financial cross-selling. People question if UPI is sustainable with zero MDR, but we’re saying we’ll continue to give rewards and scale — and it’s working,” Sikaria said.

Just to reiterate, the app’s model hinges on monetising via credit cards, personal loans, and BNPL. It is building a broad financial services stack, including credit cards, personal loans, BNPL, and secured credit products, in partnership with multiple banks.

“It’s extremely important for us to cross-sell at least one financial product to every user. That’s where our model becomes self-sustaining,” he added.

Now, as far as its acquisition strategy goes, roughly 50% of its users are organic, about 30% are driven by influencers, while the rest come through referrals.

And, as mentioned above, super.money has found its niche in a very specific demographic zone — the affluent Gen Z and millennials.

“We always wanted to emotionally connect with young users. Our core target is the young, affluent segment. None of the other players are specifically going after them,” Sikaria said.

While most UPI apps are trying to do it all – bill payments, recharges, P2P transfers, online checkouts – super.money positions itself as a ‘scan-and-pay’ first app with a decluttered, rewards-driven experience.

“The strategy is simple: Fast payments, fewer distractions and meaningful rewards. We wanted to build a no-nonsense platform, decluttered with simplified rewards. That seems to have connected well with our users,” he said.

According to the founder, the focus on simplicity is critical to look attractive to users. Also, the founder sees super.money as a neobank in the making that uses UPI as a hook to cross-sell high-quality financial products like credit cards, BNPL and personal loans at impressive rates.

The playbook seems to be paying off and not just in terms of UPI transaction growth, but also in terms of product stickiness. “On the average, a super.money user does 35 to 40 transactions per month, nearly double the market average,” Sikaria said.

Building on this strong user stickiness, super.money is now expanding its financial stack to further embed itself into users’ daily financial lives. One of its most significant strategic moves this year was the acquisition of BharatX, a checkout financing and BNPL startup.

The acquisition could help the company bolster its credit portfolio. “BNPL and EMI are a big focus for us this year. Cards, BNPL, and personal loans will be the three credit pillars we are scaling over the next six months,” a super.money spokesperson told Inc42.

Its secured credit cards, backed by fixed deposits starting at INR 90, and FDs from INR 1,000 (with returns of up to 9.5%) offer a lucrative proposition to new savers and credit builders.

While giants like PhonePe and Google Pay focus on volume and wide-base monetisation through ads, offers and coupons, super.money is intentionally targeting a narrower, high-frequency user segment.

“We aren’t chasing the 100-200 Mn user club,” the company said.

Can super.money Sustain Its Momentum?As the regulatory landscape evolves and monetising UPI remains a concern, super.money’s model may offer it a moat against any future uncertainties.

The company claims that 20-30% of its credit-eligible users have adopted its lending products, a big leap for a platform that is just one year old.

The company is actively scaling credit cards, personal loans and will soon launch EMI and BNPL products. The expansion doesn’t stop here. The founder, Sikaria, has hinted at its plans to enter wealth management and insurance as early as next year.

There’s also potential in embedded finance, and super.money is exploring partnerships that could tap into Flipkart’s network. It is also experimenting with UPI-first shopping experiences.

However, the path ahead won’t be without obstacles. Regulatory uncertainty remains a constant in the fintech space, particularly around digital credit and BNPL products.

On top of this, it faces competition from players like PhonePe, Google Pay, and Paytm, which not only have massive user bases but are now deepening their own financial services offerings.

The brand’s high-frequency, high-affinity strategy seems to be working for now, but a sustained success for super.money will depend on balancing innovation, scale, and regulatory agility over the long run.

[Edited by Shishir Parasher]

The post Can Flipkart’s super.money Outrun Rivals With Its Power User Bet? appeared first on Inc42 Media.

You may also like

Two notorious criminals arrested in Bihar after encounter with police

Two Andhra Pradesh cops killed in road accident in Telangana

New Fire TV Stick rival arrives in UK today and offers you one major advantage

Bihar Sarkari Naukri 2025: 502 vacancies in Bihar's cooperative department, salary will be more than 45000

John Hunt says 14 heartbreaking words to daughters a year after crossbow murders